8 minute read

In early 2021, Forum Investment Group made the decision to convert its Epoque Golden, a 120-unit multifamily development in Golden, Colorado, from an age-restricted 55+ community into a conventional multifamily community without age restrictions. The decision came on the heels of the coronavirus pandemic which ultimately stalled the lease-up of the 55+ community. In this blog post, we’ll look at some of the challenges of a 55+ strategy in the midst of a pandemic, as well as the real estate fundamentals that enabled Forum to pivot its business plan.

To understand the principles which allowed Forum to shift its strategy, it is important to understand the genesis of the 55+ asset class. The “senior community” concept emerged in 1960 when Del Webb unveiled Sun City, AZ, the first seniors-only community and the predecessor of the wildly successful Del Webb communities which have since sprung up across the country. In the years that followed, developers and operators built out the senior care continuum and capitalized on a for-rent model which offered varying levels of care for an individual depending on their lifestyle and care needs.

Traditionally, when an individual makes the decision to transition into senior housing from homeownership or conventional apartments, they begin at an Independent Living community. The main component that separates an Independent Living community from conventional multifamily housing is the existence of a commercial kitchen and a business model which provides residents with three meals per day. With the “meal plan” being the main feature of this housing type, there is not much of a care component. However, as an individual ages, they will move to higher acuity communities that offer greater levels of care such as Assisted Living, Memory Care, Skilled Nursing, and so on.

For decades, this general model had served America’s senior demographic well. Over the last twenty years, however, the US has seen a fundamental shift in the makeup of America’s seniors. First and foremost, the baby boomer generation began to transition from America’s workforce to America’s retirees. Second, advances in medicine and nutrition led to prolonged good health. The result was a tsunami of retirees that had many years of healthy living ahead of them before they would need to transition to care-focused senior housing.

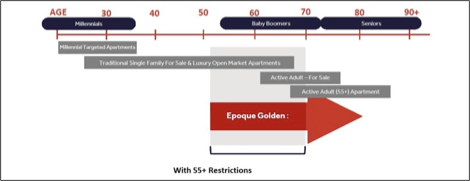

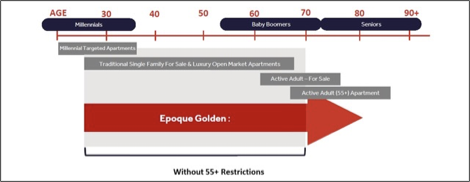

This new, healthy cohort of Active Adults prompted the creation of a new addition to the senior housing continuum – 55+ for-rent apartments – designed to provide an alternative to homeownership for the active adult/young retiree who wants to live a “friction-free” lifestyle without a senior care component. Simply put, the 55+ product was designed to bridge the gap between conventional multifamily housing and senior care communities. While most 55+ communities are designed to be highly amenitized to provide a resort-style feel, the product itself can be generally defined as Class A apartments with a 55+ age restriction. In fact, most real estate investors (and many real estate lenders) consider 55+ apartments to be an offshoot of multifamily as opposed to a subset of senior housing.

Forum made the decision to delve into the 55+ space with Epoque Golden. Fundamentally, it aligned with our track record of excellence in the multifamily space. The age restriction component also allowed us to break into a market in Golden, CO that has historically been very challenging for conventional multifamily developers, as Golden is committed to limiting conventional multifamily development. Going into it, we knew that a inherent challenge of the 55+ space was the long lead time ahead of lease execution, which averages about 18 months. This long lead time is primarily a result of the fact that many prospective renters are making the heavy decision to leave their longtime home. Not only does it take a high-touch experience over a long period of time to get a prospective 55+ renter comfortable with a community, but the process of selling a home and downsizing to an apartment takes considerable time and preparation.

Fast forward to 2020, and this 18-month lead time is frozen indefinitely. Communities like Epoque were forced to press pause on move-ins to protect the current residents from a potential Covid-19 outbreak. The few residents who were allowed to move in were being asked to quarantine for 14 days. Understandably, prospective renters opted to simply stay put until there was long-term clarity around public health and the economy. As a result, lease-up at the Epoque Golden flatlined.

As discussed above, the underlying real estate is essentially highly-amenitized, Class-A apartments, which lends itself to a relatively seamless transition to multifamily. Fortunately, through the hard work of Forum’s Asset Management team and the good graces of the City of Golden, we were permitted to remove the age restrictions from the Epoque Golden. As illustrated below, this is expected to enable the community to market to a much broader renter base, ranging from millennials to seniors.

Changing a business plan is never an easy thing to do, but this is what a strategic investor does. When the market makes a change, we make the hard decision to move. Others follow. We also understand Asset Values, and this is another reason why we made this change. We could. If we have completely over built this product, we could never get close to the rents needed to do so. Our ability to stay nimble has helped us overcome challenges in the past, and it will continue to serve as a core investment principle for Forum as we grow.

Patxi Colbern, Director – Business Development

pcolbern@forumcapadvisors.com

Forum Investment Group, a Denver, Colorado-based real estate investment firm with a focus on multifamily living – develops owns, operates and manages properties across the United States.

Leave Comment