7 Minute Read

Coming out of a severe economic downturn, it’s impossible to make a blanket statement about commercial real estate in 2021. Rarely, perhaps ever, has the outlook for different commercial real estate segments been so uneven.

This is in large part because the pandemic has pushed forward several secular trends that are reshaping select real estate sectors. On the other hand, the environment has also underscored which segments are absolutely essential.

This blog provides a brief outlook for each commercial real estate sector, with an explanation of the trends affecting it this year:

Retail: Among real estate sectors, retail has perhaps been most affected by the pandemic. Stay-at-home orders pushed forward ecommerce and online shopping. This is reflected in property prices. Class A malls and the few other prime locations that will still experience high tenant demand are extremely expensive. On the other end of the spectrum, nearly everything else is relatively cheap, but risky, given how shopping trends are changing.

Hospitality: With fewer people travelling or taking vacations, one statistic says a lot about the sector: Occupancy rates slid down to 40% in 2020. Occupancy rates could continue to hover at those low rates for much of this year. We would expect the sector to fully rebound in 2023.

Office: There are many questions surrounding office real estate. It remains to be seen whether – or how many – companies will downsize offices as more employees become accustomed to working from home. On the other hand, post-pandemic, redesigned offices may require more square footable to create more spacing for employees. Until there is more clarity around these issues, lenders are offering less attractive financing for office property than for some other commercial real estate sectors.

Industrial: The outlook for the industrial sector is favorable relative to many others, with cap rates shattering records in many U.S. markets.1 We expect continued strong demand for industrial space for data centers and e-commerce disibution facilities, as retailers seek more facilities to meet online shopping demand.

Multifamily: By and large, the recessionary environment of 2020 underscored the resiliency of the multifamily segment. The basic necessity of having a roof over one’s head translated into firm occupancy rates and durable revenue streams, even as the government enacted eviction moratoriums. At Forum, we’ve seen this in our own multifamily portfolios, where portfolio collections held steady at 94.3% for 2020, compared to 94.6% the year prior.

Going forward couple other dynamics favor the sector. From a pure supply and demand perspective, we believe the sector is underdeveloped, though individual markets vary. From a demand perspective, in large cities home prices have outpaced wage growth for much of the last decade, putting home ownership out of reach for a growing subset of the population, making them renters by necessity. This should continue to support rental demand.

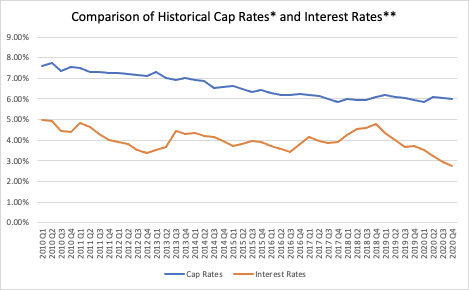

Another powerful tailwind should be supportive for the segment: Cheap financing. Whereas low rates are a headwind for investors searching for yield, it may well prove a boon for the multifamily market. The government is aware of the need for more affordable housing options for the middle market and is pushing capital toward addressing the issue. This has pushed down financing costs and widened the gap between the industry’s cap rate and financing record to one of its widest levels in the past decade.

The chart below puts this gap in perspective. It compares historical cap rates for the multifamily sector (courtesy of CoStar), with Freddie Mac’s conventional, conforming 30-year fixed mortgage rates, and shows how wide the gap between the two has become.

We believe cheap financing, coupled with the multifamily sector’s durability, make it the most attractive commercial real estate sector as the economy is poised to recover.

1 https://www.cpexecutive.com/post/just-how-strong-is-industrial-real-estate/

Ryan Mase, Director – Business Development

rmase@forumcapadvisors.com

Forum Investment Group, a Glendale, Colorado-based real estate investment firm with a focus on multifamily living – develops owns, operates and manages properties across the United States.

Leave Comment