6 Minute Read

With traditional sources of investment income looking risky or offering paltry yields, a growing set of investors are turning to commercial real estate. There is only one challenge: Getting a seat at the table.

Access to large-scale, high-quality, commercial real estate is hard to come by, particularly in economic downturns, when investors compete for fewer deals. This is particularly true for the more resilient sectors of commercial real estate, such as multifamily housing, as income-hungry investors of all scale – including large pensions and insurance companies – gravitate toward the sector for its steady, resilient cash flows.

Commitment funds level the playing field for the smaller investor. When backed by the right sponsor, they bring institutional-quality real estate access and expertise to individuals who lack the capital to purchase those properties on their own.

Innovative commitment fund models are also preserving many of the tax advantages that come with typical property ownership and passing those benefits to end investors. This blog looks at how these funds are helping individuals gain access to the increasingly competitive multifamily market.

Multifamily: The Safe Haven of the Commercial Real Estate Market

Investment mandates for commitment funds vary, but the goal of the funds is to pool large sums of capital so that individual investors can receive partial ownership of a diversified portfolio of high-quality properties. This can mean investing in sectors such as multifamily real estate, which has historically produced more resilient cash flows than commercial real estate sectors such as retail.

The sector’s durability is due largely to its bare necessity: People need a roof over their head and rent is the last thing an individual or family cuts from the budget.

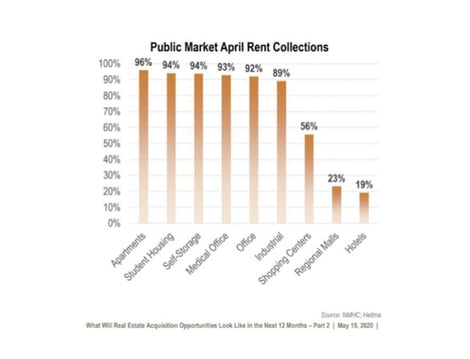

The two charts below highlight the resiliency of multifamily real estate. The first chart shows how its cash flows held up relative to other commercial real estate sectors as the economy softened this spring.

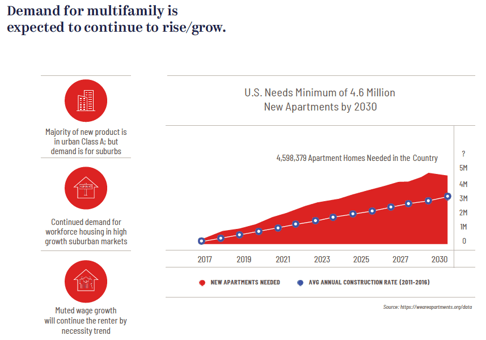

The second chart shows why multifamily should remain a source of durable income for the long term. Homeownership rates are at all-time lows and single-family housing is unattainable for many. As home prices continue to out-pace wage growth and renters look for more flexibility on where they live, demand for more attainable rental housing is expected to dramatically rise over the next decade. As the chart shows, the U.S. will need another 4.6 million apartments over the next decade to keep up with demand.

Commitment Funds Make Multifamily Properties Accessible

The durable income profile of multifamily real estate creates fierce competition for high-quality properties, particularly in the most attractive markets. An economic downturn can actually heighten competition. For example, in May, multifamily property transaction activity was down 80% from the same period last year. But there are still a significant number of buyers willing to commit capital.

In such a competitive environment, high-quality properties are white glove marketed, and only select buyers with committed capital are invited to compete for a potential purchase. Commitment funds allow individual investors to partner with those firms that have the heft to participate and have built trusted partnerships in the industry.

Commitment Fund’s Unique Structure Offers Tax and Ownership Advantages

Commitment funds can be structured quite differently from a traditional real estate fund or REIT. Investors in the fund directly own a portion of the property. As such, the traditional tax benefits of real estate ownership such as depreciation, losses, or, potentially, the deferral benefits of 1031 Exchanges, all flow to the individual investor. The fund essentially provides the benefits of direct exposure to a pool of income-producing multifamily properties, but without the burden of underwriting each individual transaction.

Depending on the structure, commitment funds can also give investors the ability to increase their investment in an acquisition prior to non-fund investors, giving fund investors a first-mover advantage in capitalizing on the real estate manager’s insights.

Individual Investors Deserve – and Need – Access to Multifamily Real Estate

In summary, the bare necessity of housing has translated into durable, resilient income streams for the multifamily sector. Large institutional investors are aware, making competition for high-quality properties in attractive markets fierce. Commitment funds from the right partner allow individual investors to access those same properties.

In an environment where the individual investor’s traditional income options (i.e. bonds) offer little in the way of yield, that access is critical.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Forum Investment Group is a private real estate investment firm with expertise and emphasis on generating current income and long-term value creation by accessing unique real estate acquisition, development and debt investment opportunities across the capital stack and real estate cycles. Since 2007 we’ve invested more than $2 billion in real estate and built a successful track record of high-performance investments, earning the trust of our investors and partners.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Darren Fisk – Founder and CEO

dfisk@forumre.com

Forum Real Estate Group, a Glendale, Colorado-based real estate investment firm and affiliate of Forum Investment Group, has a focus on multifamily living and develops, owns, operates and manages properties across the United States.

DISCLAIMER:

The information contained herein is only as current as of the date indicated and may be superseded by subsequent market events or for other reasons. The views and opinions expressed herein are those of the author and do not necessarily reflect the views of Forum Real Estate Group (“Forum”), Forum Capital Advisors, LLC (an affiliate of Forum Real Estate Group, an Exempt Reporting Adviser and manager of private funds), its other affiliates or its employees. This information is not intended to, and does not relate specifically to any investment strategy or product that Forum offers. It is being provided merely to provide a framework to assist in the implementation of an investor’s own analysis and an investor’s own view on the topic discussed herein. Past performance is not a guarantee of future results. There can be no assurance that any investment strategy will be successful. Historic market trends are not reliable indicators of actual future market behavior or future performance of any particular investment which may differ materially, and should not be relied upon as such. This should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy. The investment strategy and themes discussed herein may be unsuitable for investors depending on their specific investment objectives and financial situation. Diversification does not eliminate the risk of experiencing investment loss.

This material is intended for informational purposes only and should not be construed as legal or tax advice, nor is it intended to replace the advice of a qualified attorney or tax advisor

Leave Comment