5 minute read

Investors of all scale must confront a looming crisis: The struggle to find income. Whether an individual targeting a specific cash flow to support their retirement lifestyle or a large pension needing to fund liabilities, investors have always needed income. But a 11-year bull market has allowed them to ignore that traditional income sources have all but dried up.

Less risky areas of the bond markets have offered paltry yields since the financial crisis. However, as stocks continued to rise with relatively high volatility, investors could overlook low yields and rely on capital returns from equity markets to fund income needs.

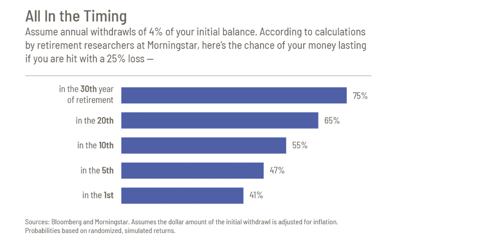

But what happens when the market turns the other way and distributions become a larger percentage of your asset base? A deteriorating economic backdrop and recent volatility have forced investors to consider this scenario. And it isn’t pretty.

The chart below illustrates the chances of running out of money in retirement if you experience a substantial drawdown from equities.

Traditional Income Sources Have Little to Offer

So, what is the answer for retirees, pension plans, foundations and endowments with a need for predictable income? The old standbys for cash flow have always been investment grade debt, high-yield bonds, and today, floating rate notes and private debt.

We took a deeper dive into the topic in our last blog, but these and other traditional income sources offer either razor-thin yields or look increasingly risky. In short, monetary policy in large, developed economies and a rush into safe-haven assets following the coronavirus pandemic have pushed government bond yields to unprecedented lows. This, in turn, has compressed yields in other fixed income markets, which at the same time face increased risk.

The outlook for corporate debt is particularly worrisome. Many corporations have loaded up on debt, but little has gone toward funding productive capacity. Rather than borrow to invest in revenue-generating projects, companies have gobbled up cheap debt to fund share buybacks. As the economy slows, these businesses could struggle to repay that debt.

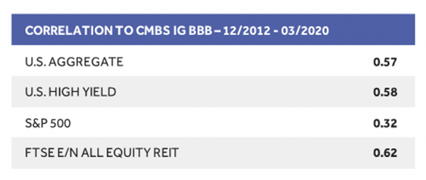

In addition to increased risk, the strong correlation between high yield debt and equities presents another problem. Traditionally bonds are intended to serve two purposes: provide income and protect from equity market downturns. High correlations mean stretching for yield and increasing an allocation to junk bonds will not provide investors the diversification or portfolio ballast they expect from fixed income.

Where Do Investors Turn for Cash Flow?

With traditional sources of income drying up – and equity market returns looking less likely to fill the void – investors must find reliable cash flow elsewhere. Real estate debt can provide a solution to the cash flow crunch.

Real estate-related investments across the capital stack offer a stable and predictable source of cash flow with a diversifying set of risk factors. This has historically led to low correlations relative to traditional asset classes.

“Real estate-related investments across the capital stack offer a stable and predictable source of cash flow with a diversifying set of risk factors. This has historically led to low correlations relative to traditional asset classes”

Real Estate Debt: Resilient Cash Flows, Low Correlations

Real estate-related debt became a four-letter word among market participants during the financial crisis but has undergone a renaissance since then. The conservatorship of the government lending agencies (Freddie Mac and Fannie Mae) created a new market for risk transfer securities in which high-quality, multifamily residential loans are pooled into a vehicle which is sold to the private market, via auction in many cases.

The rise of massive, successful institutional real estate sponsors such as Blackstone has also reinvigorated the CMBS market, specifically in single-asset, single-buyer transactions. These institutional sponsors are well capitalized, reducing the risk of sponsor default and related issues in the rest of the capital stack.

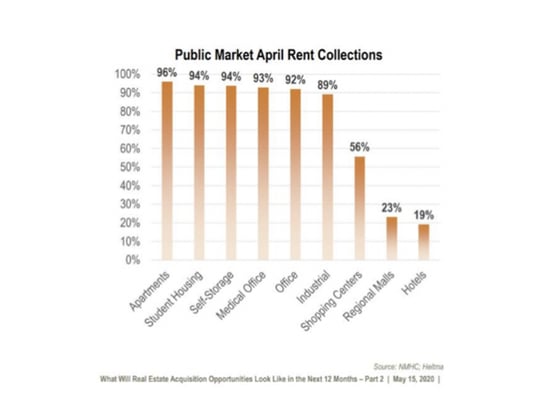

Many areas of real estate are also likely to prove more resilient to the economic fallout associated with the pandemic. As the chart below shows, a weakening economy has put pressure on cash flows from real estate sectors related to hospitality, retail and even some office real estate. But other areas such as multifamily residential, medical office and industrial real estate remain resilient.

Multifamily real estate debt – the largest focus for Forum – looks particularly steady. This is due largely to its necessity: In any economic environment, everyone still needs a roof over their head. While there likely could be rent discounting, forbearance, trading up and trading down, occupancy – which drives cash flow – should not dip too dramatically and likely will recover quickly.

Given the resiliency of cash flows and low correlations to other asset classes, real estate debt could play an essential role in avoiding the looming retirement income crisis.

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Forum Investment Group is a private real estate investment firm with expertise and emphasis on generating current income and long-term value creation by accessing unique real estate acquisition, development and debt investment opportunities across the capital stack and real estate cycles. Since 2007 we’ve invested more than $2 billion in real estate and built a successful track record of high-performance investments, earning the trust of our investors and partners.

Learn more about Forum Investment Group at: forumre.com / forumcapadvisors.com

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Nick Thompson – Senior Managing Director

nthompson@formcapadvisors.com

Forum Real Estate Group, a Glendale, Colorado-based real estate investment firm and affiliate of Forum Investment Group, has a focus on multifamily living and develops, owns, operates and manages properties across the United States.

DISCLOSURE:

The materials to which this disclosure is attached as well as any electronic or verbal communication related to the subject matter of these materials are intended for informational purposes only, are subject to change, and do not constitute investment advice or a recommendation to you. Such an offer to sell or solicitation to buy an interest in the Fund may be made only by the delivery of the Fund’s Confidential Private Placement Memorandum (the “Memorandum”) specifically addressed to the recipient thereof. In the event that these materials and the Memorandum are conflicting, the Memorandum’s terms shall control. Please review the Memorandum fully and consult with your legal and tax counsel, as appropriate. All documents should be reviewed carefully by you and your financial, legal, and tax advisors. Any product or service referred to herein may not be suitable for all persons. This information is intended solely for institutional investors/consultants, foundations and endowments as well as for “accredited investors” (as defined by the Securities and Exchange Commission (“SEC”) under the U.S. Securities Act of 1933, as amended). Any reproduction of these materials, in whole or in part, or the divulgence of any of the contents, is strictly prohibited (excepting that the tax treatment and tax structure of any Fund may be disclosed as necessary), except to the extent necessary to comply with any applicable federal or state securities laws. These materials are intended for the exclusive use of the designated recipients and may not be reproduced or redistributed in any form or used to conduct any general solicitation or advertising with respect to any Fund or investment discussed in the information provided. The Fund has not been registered or qualified with, nor approved or disapproved by, the SEC or any other regulatory agency nor has any regulatory authority passed upon the accuracy or adequacy of any information that has been or will be provided. In addition to restrictions on the transference of an investor’s interest in the Fund, there is no secondary market for the Fund, and none is expected to develop. Fees and expenses may offset the Fund’s portfolio’s trading profits. Although the Fund or investment professionals managing it may have a significant track record, this type of investment should be considered speculative and involves a high degree of risk. All materials are meant to be reviewed in their entirety, including footnotes, legal disclaimers, and any restrictions or disclosures. Past performance is no guarantee of future returns. The Fund’s performance may be volatile, and the investment may involve a high degree of risk. The Fund is intended only for sophisticated investors who meet the investor suitability requirements described in the relevant Memorandum and who can bear the risk of investment losses, including the potential loss of their entire investment.

Leave Comment