6 Minute Read

In a U.S. rental market that spans a wide range of geographies and demographics, we see the most opportunity within a niche market segment: Middle-market housing.

This unique – but growing – market segment is broadly defined as the population of renters who earn too much to qualify for government subsidized, low income properties, or do not have the down payment required to purchase a house. Individuals within this group are “renters by necessity.”

Caught in the middle, this underserved market segment currently finds itself at a crossroad of undersupply and heavy demand, that has established it as the big trend in multifamily real estate development and investment.

From the supply side, many developers historically have ignored the workforce housing need, focusing instead on the higher revenues associated with luxury rentals or the lower end of the market, with incentives associated with government assisted housing.

But the need for workforce housing is real … and growing dramatically. Market and demographic forces such as delayed household formation, primarily a result of younger generations waiting longer to marry, have put more renters into this market segment. So too, have rising home prices and rental rates and a lack of wage growth for many middle market Americans. This is particularly true for geographies in the Mountain West and West Coast – the main areas of Forum’s own middle-market housing efforts – where economic and population growth are pushing up rental prices.

While the investment case for middle-market housing seems clear at the 10,000 foot view, a few data points, courtesy of the Harvard Joint Center for Law and Policy’s America’s Rental Housing 2020 report, bring the picture into sharper focus. Below is a by-the-numbers look at the factors underpinning growth for the middle-market housing segment, and a few statistics that also speak to growth potential in the specific geographies that Forum is focusing:

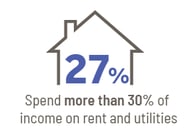

27% of U.S. renter households earning $45,000 to $75,000 in income in 2018 who are housing “cost burdened,” which means they spend more than 30% of income on rent and utilities. This segment makes up a large portion of the rental population. The fact that they are dedicating such high portions of income toward rents suggests the need for more affordable, middle-market housing.

This is the change in average income from 1989-2019 for renters in the middle quintile of U.S. income. With incomes rising at such a slow rate, the demand for affordable, workforce housing is unlikely to ebb soon. With incomes rising at such a slow rate, the demand for affordable, workforce housing is unlikely to ebb soon.

The outsized growth for this market has led many developers to focus on this niche, and leave the middle-market segment behind. As the next statistics show, we believe this has created more favorable supply/dynamics for those who invest in middle-market housing.

This represents the difference in rent growth versus inflation over a seven-year period from 2012 to 2019. It points to how quickly rental expenses have gotten out of hand for middle income wage earners.

Yes, every single quarter for over seven years of real (inflation adjusted) rent growth nationally*, the second longest such streak in records dating back to the 1940s. While the statistics above support the need for middle-market housing nationally, Forum is focusing on areas where it is most acute. These are often in the Mountain West and West coast cities, where population and economic growth underpin rising rental prices and demand for affordable, middle-market housing. The statistics below lend perspective for the investment case within these markets:

The share of U.S. rental households in the Denver Metro area earning $45,000 to $75,000 who are cost burdened (again, spending more than 30% of income on rent/utilities). This has grown from just 24.2% in 2011!

30% of U.S. renter households earning $45K-$75K income in 2018 who are housing cost burdened in Forum’s Top 8 target markets. In 2011, the cost burden figure in our markets was 3.5% below the national average but by 2018, this figure blew past the national average by nearly 3%!

5.05 is the home price-to-income ratio for Denver, making it the 14th most expensive housing market in the U.S. by this metric, and sixth highest outside of California. The lack of affordable homes suggests rental demand should remain strong.**

How is Forum Addressing the Middle-Market?

Given the income, demographic and market forces at work, Forum sees long-term tailwinds for investment in middle-market Housing – particularly in our target market geographies. We have pivoted our development strategy to address this growing demand.

Our new development efforts in Denver- The Parallel and Enova- serve as an example. Only 36% of renter households in the Denver Metro area have a household income above $75,000, yet the majority of multifamily development has targeted this segment, often manifesting as top rents for luxury products in the urban core.

On the other hand, we have found that those earning less than $60,000 in the Denver market have very limited product options. We are targeting this segment, focusing our efforts on more affordable properties in suburban areas. We are relying on our development expertise to create attractive – but affordable – amenities within these suburban properties that should appeal to families and individuals in the middle market.

We believe the more limited supply in the middle market segment will result in stable rent growth and lower vacancy rates for this underserved segment.

* As of the third quarter 2019.

**Source: Clever, courtesy of Zillow statistics.

Brad Weinig, Senior Director – Workforce Housing

bweinig@forumre.com

Forum Investment Group, a Glendale, Colorado-based real estate investment firm with a focus on multifamily living – develops owns, operates and manages properties across the United States.

DISCLOSURE:

The materials to which this disclosure is attached as well as any electronic or verbal communication related to the subject matter of these materials are intended for informational purposes only, are subject to change, and do not constitute investment advice or a recommendation to you. Such an offer to sell or solicitation to buy an interest in the Fund may be made only by the delivery of the Fund’s Confidential Private Placement Memorandum (the “Memorandum”) specifically addressed to the recipient thereof. In the event that these materials and the Memorandum are conflicting, the Memorandum’s terms shall control. Please review the Memorandum fully and consult with your legal and tax counsel, as appropriate. All documents should be reviewed carefully by you and your financial, legal, and tax advisors. Any product or service referred to herein may not be suitable for all persons. This information is intended solely for institutional investors/consultants, foundations and endowments as well as for “accredited investors” (as defined by the Securities and Exchange Commission (“SEC”) under the U.S. Securities Act of 1933, as amended). Any reproduction of these materials, in whole or in part, or the divulgence of any of the contents, is strictly prohibited (excepting that the tax treatment and tax structure of any Fund may be disclosed as necessary), except to the extent necessary to comply with any applicable federal or state securities laws. These materials are intended for the exclusive use of the designated recipients and may not be reproduced or redistributed in any form or used to conduct any general solicitation or advertising with respect to any Fund or investment discussed in the information provided. The Fund has not been registered or qualified with, nor approved or disapproved by, the SEC or any other regulatory agency nor has any regulatory authority passed upon the accuracy or adequacy of any information that has been or will be provided. In addition to restrictions on the transference of an investor’s interest in the Fund, there is no secondary market for the Fund, and none is expected to develop. Fees and expenses may offset the Fund’s portfolio’s trading profits. Although the Fund or investment professionals managing it may have a significant track record, this type of investment should be considered speculative and involves a high degree of risk. All materials are meant to be reviewed in their entirety, including footnotes, legal disclaimers, and any restrictions or disclosures. Past performance is no guarantee of future returns. The Fund’s performance may be volatile, and the investment may involve a high degree of risk. The Fund is intended only for sophisticated investors who meet the investor suitability requirements described in the relevant Memorandum and who can bear the risk of investment losses, including the potential loss of their entire investment.

Leave Comment